Cryptocurrency, particularly Bitcoin, has been a hot topic in recent years. Unlike standard bills and coin, cryptocurrencies are entirely digital and have no corresponding physical element. Money no longer belongs exclusively to large financial institutions and governments, but to the users themselves, who can earn or mine Bitcoin in various ways. It also works as an investment option, and a single coin has been worth as much as $19,000. Because this type of currency is so new, people everywhere are wondering how it works, how to get it, and whether or not it’s worth the investment.

Bitcoin and cryptocurrency

With cryptocurrency, there are no bills or metal coins. Bitcoins are blocks of data that act as currency. Beyond this difference, cryptocurrencies and other money are essentially the same. You can spend Bitcoin on items just as you would a dollar or other unit of currency. Very few businesses currently allow users to pay in Bitcoin, though this is changing. Users often rely on online Bitcoin trading sites and marketplaces to exchange goods and services for Bitcoin.

Keeping Bitcoin secure

Cryptocurrencies like Bitcoin rely on a new form of cryptography called a blockchain to both create new “coins” and verify existing transactions. The Bitcoin blockchain is a list of “blocks” that contain information about other blocks and various transactional data. When a user joins the Bitcoin network, they receive a copy of the blockchain that updates regularly. If two users’ blockchains differ, the system automatically prefers the longer one. Because the blockchain with more users will be longer, that one is the most trustworthy. This makes it extremely difficult for hackers or human error to mess with Bitcoin transactions.To take advantage of this rule, someone would need 51% of the machines on the network. As more people use Bitcoin, this becomes increasingly difficult. If there are 5 million people using Bitcoin, a hacker would need a network of 2.5 million machines to interfere with the system.

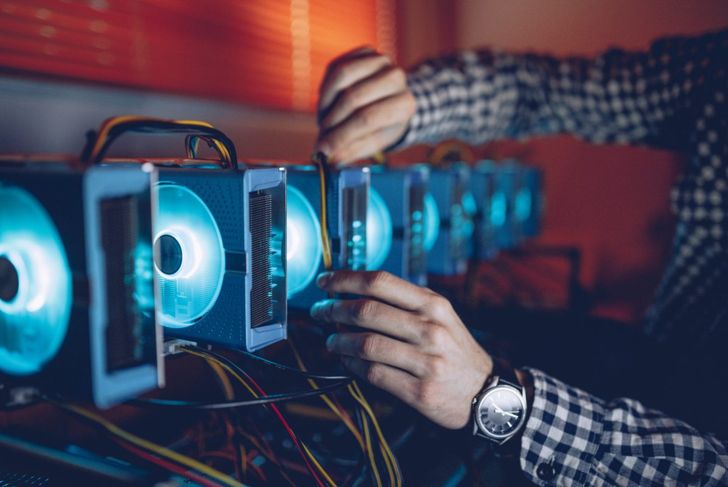

Earning Bitcoin through mining

Unlike conventional currencies, there isn’t a government authority that prints or creates Bitcoin. To earn Bitcoin, users called “miners” use machines to provide processing power to a massive peer-to-peer network. The network harnesses this power to run a complex algorithm called a “hash” to verify Bitcoin transactions. Whenever a computer “hashes” a block from the blockchain, it rewards that machine with Bitcoin. The transaction then becomes public information and is stored as a block on the blockchain. Remember, out of millions of miners, only one machine will verify the transaction and receive Bitcoin in return.

What equipment is necessary for mining

Early on in Bitcoin’s life, users could mine for coins using a normal home computer. However, as the process caught on, mining became more difficult. To run smoothly, the Bitcoin system aims to produce a single block every 10 minutes. With more machines, mining becomes more efficient, so the system makes mining more difficult. This caused users to rely on several high-end graphics processing units (GPUs) in a machine to maximize effectiveness. However, due to Bitcoin mining’s rise in popularity, the prices of the most efficient GPUs have dramatically increased. Since the ultimate goal of mining Bitcoin is to earn money, this price increase demands a substantial initial investment. Users now prefer application-specific integrated circuits (ASICs), which are essentially specialized Bitcoin mining machines.

The risk of Bitcoin cloud services

If purchasing the hardware seems like too steep an investment, there are some other options available. You could purchase a Bitcoin cloud mining contract. Some companies buy massive numbers of Bitcoin mining hardware and essentially “rent” them to users around the world. While this simplifies the process significantly, it’s also a greater risk. Not only do you not own or have access to the physical hardware, but many of these businesses have predatory contracts or business practices. Always thoroughly research a service before using it.

How to store Bitcoin

To start mining or trading Bitcoin, you first need a way to store it. Generally, you have three options: mobile wallets, desktop wallets, and hardware wallets. Mobile Wallets Pros:

- Portable, install on your phone or tablet

- Great for in-person Bitcoin trades

- Can use QR codes for quick, efficient trading

Mobile Wallets Cons:

- App marketplace may remove the app from the store, preventing future updates

- Losing the device may lead to an inability to access funds

Desktop Wallets Pros:

- More in-depth options, more control over funds

- Some come with hardware wallet support

Desktop Wallets Cons:

- Difficult to use QR codes

- Susceptible to malware/spyware targeting Bitcoin users

Hardware Wallets Pros:

- Arguably the most secure

- Can store large amounts of Bitcoin

Hardware Wallets Cons:

- Difficult to use on the go or while traveling

- Difficult to use QR codes

- Loss of device means complete loss of funds, must have a backup in place

How to mine for Bitcoin

Once you have your hardware and wallet, you need to download a program to mine for Bitcoin. The most popular programs use a command-line interface, meaning that there is no visual interface to interact with. If that sounds confusing, there are a few options available that have a traditional interface. Research your options and determine what fits your needs. Many software choices come with tutorials or guides that walk you through how to use the program.

Increase your efficiency with a pool

By design, the more people mining for Bitcoin, the less likely any single machine will receive the Bitcoin reward. This has pushed out most single users or those with small mining farms in favor of those who can afford large-scale mining operations. To combat this, some users have created mining pools that combine their resources and eventually share the rewards between each user. Often, the share of the reward stems from how much you contributed to the effort. When choosing a mining pool, make sure to compare their pool size, cost, and overall reliability.

Is Bitcoin mining worth it

The question remains: is mining worth it? Mathematically speaking, probably not. Mining for Bitcoin is more of a profession than a hobby, and it’s become a matter of scale. A single high-end GPU costs around a thousand dollars. That's not accounting for the cost of cooling, electricity, and other necessary components. As of July 2020, a high-end GPU earns slightly over a dollar a day and will pay for itself in around 19 months. Comparatively, ASICs are cheaper and more efficient than GPUs, allowing them to profit more quickly.In theory, this allows for noticeable profit within a year. However, the chances of a single user out-mining large-scale mining farms are incredibly low. Additionally, Bitcoin's value is incredibly volatile, and its price could crash at any time, dramatically increasing the time it takes to turn a profit. And, unlike stocks, Bitcoin has significantly fewer methods to ensure market stability.

How spending Bitcoins works

In a standard transaction, there are usually three elements: a debit card that connects to a bank account, the bank that verifies the transaction, and the store that receives the money from the transaction. Bitcoin essentially has the same three elements. You store Bitcoin data in a wallet. You send a transaction request to another Bitcoin user, the peer-to-peer Bitcoin system verifies the transaction, and the final user receives the Bitcoin.

Home

Home Health

Health Diet & Nutrition

Diet & Nutrition Living Well

Living Well More

More